You have a property that has got its debt waived off already and this provoked you to sell off the property.

However, the buyer questions you about the debt history. This is where the lien release form comes into the picture.

Irrespective of the type of property that you wanted to sell off, the lien holder needs to maintain the release form. Wanted to know more about how this works?

We have it covered in this article along with ready to use release of lien forms.

Release of lien forms

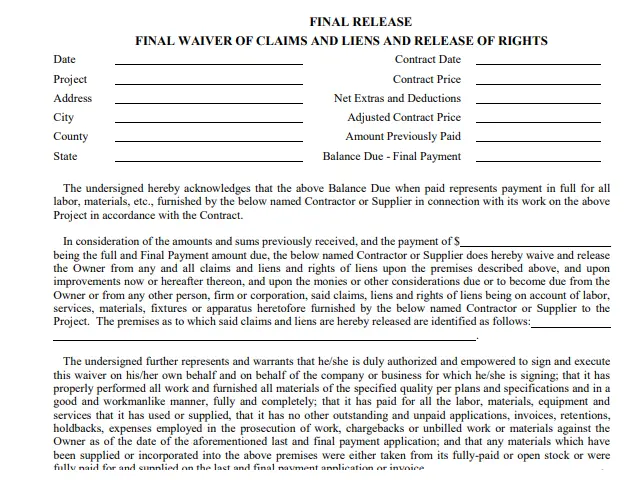

1. Final release of lien form

There are different stages at which a complete release of lien is issued. If you have paid partially, you may receive a partial release.

There are different stages at which a complete release of lien is issued. If you have paid partially, you may receive a partial release.

However, if you have settled completely, you are provided with a final waiver of claims. The following template also lists the release of rights to you so you can decide on the usage of the property further.

Until you receive this release of lien form, you are not encouraged to own the rights to their entirety.

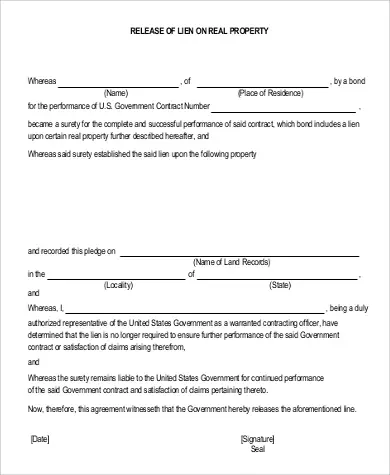

2. Release of lien on real property

If you suspect the applicability of lien form on property, you should use the following lien release template.

The best part about it is that it abides by the laws of the United States government relating to the land resale.

Instead of having a detailed release of lien form that makes it hard for the buyer to read and take notes, the following is a helpful lien release document that is not only crisp but also accurate.

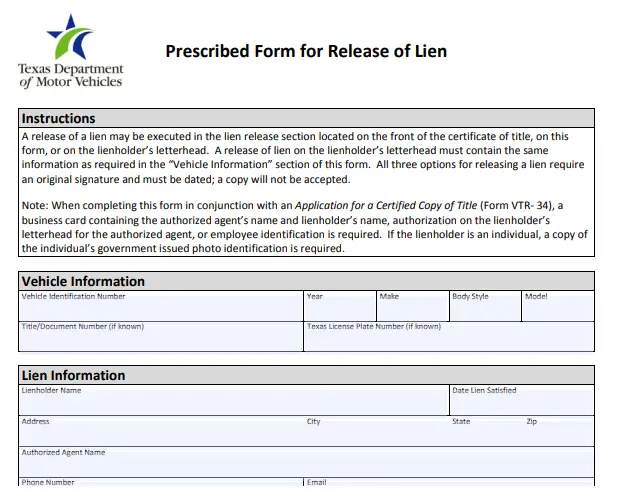

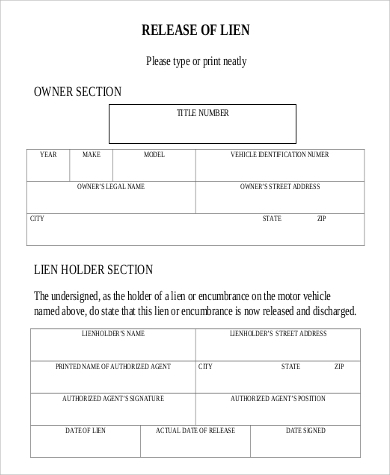

3. Release of lien for vehicles

Mortgaged your vehicle for an emergency but managed to get it back? Ensure that you file the lien release immediately from the financial institution.

If you delay this process, you may be exposed to a range of legal consequences. If you look at the document template below, it is detailed enough so it does not arouse suspicion at any moment. For instance, it includes lien information, vehicle information, and possession of certification.

This is the format followed by the Texas Department of Motor Vehicles. If you live in a different state, all that you need to do is to visit the state website and then download the form. If it is unavailable, simply edit the header area.

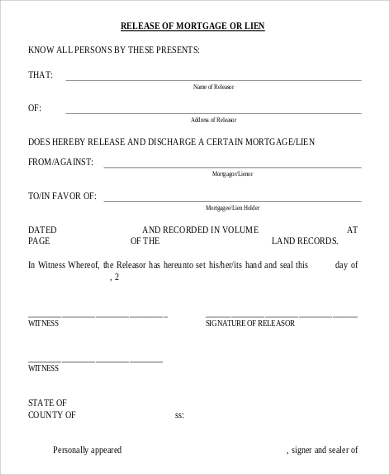

4. Release of mortgage form

If you have got your asset released from a private source you personally know, it is impossible to expect the person to provide a document with complete information.

Instead, you can carry this lien release that has instructions beneath every space lien holder. It is easy to use and you can also use lien release file the legally binding agreement for future reference.

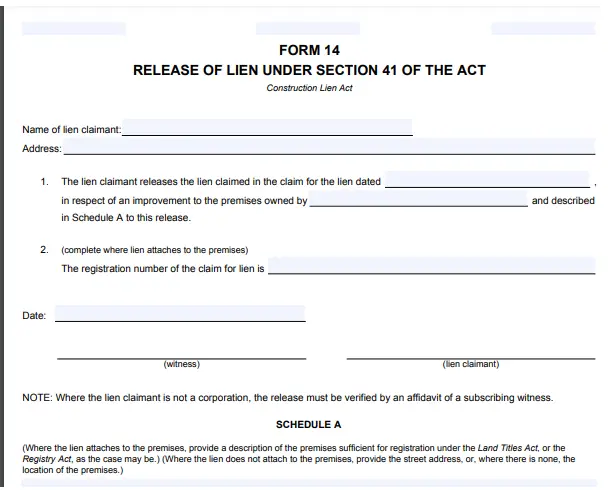

5. Release of lien under Section 41 – lien waiver

There are different regulations covering the release of lien including contractor’s lien release, form 12277 (IRS lien release), and mortgage lien release.

If you look at the fillable, editable lien waiver template below, you can understand that form 14 includes information that is as per section 41 of the Construction Lien Act. As you go by this act, it increases the chance of getting your property sold without hassles.

While the first page lets you fill in basic information, the information under schedules list coverage, inclusion, and exclusion.

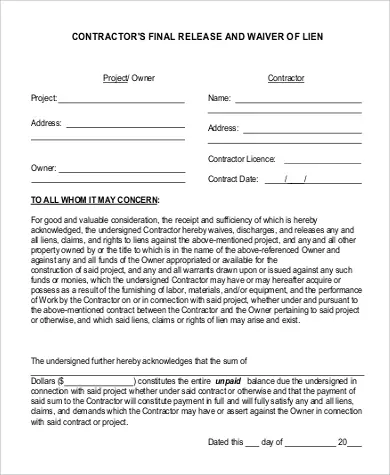

6. Contractor’s final release and waiver of lien

Release of lien is prominent in project management situations where the project owner holds specific rights until the achievement of a milestone after which waiver of rights is allotted to the contractor. The following lien waiver template covers the detail of both sides with progress payment or full payment and unconditional waiver and get paid.

As a contractor, you may abide by the instructions given in the lien form to release a lien.

7. Tabulated waiver and release of lien

Do you prefer using a lien form that is well-tabulated and explanatory from the first look? Here you go with an extremely interesting template!

This mechanic’s lien release has multiple sections to explain the real estate owner, lienholder, the product being held, lien exclusions, and the amount involved. The best part is the way the lien sections are arranged. It is not only neat but also useful in making quick decisions even in the case of mechanic’s lien release.

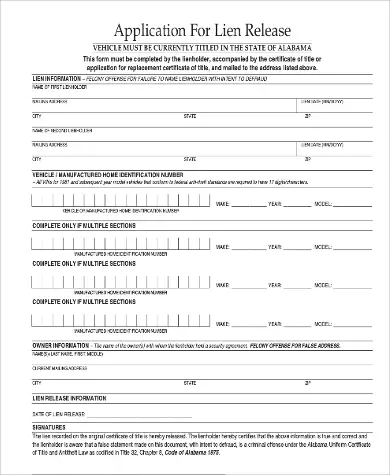

8. Application for a lien release

If you have borrowed from a reputed real estate financial institution, you may be expected to apply for lien release form and the internal department upon progress might consider your request.

It is not easy to get this process done. It has to go via various stakeholders and you are also expected to wait for a specified duration as mentioned by the law firm.

During this period, the rights get transferred to you. The best part is that getting the final lien form becomes authentic and highly valid thereby restricting any sort of lien suspicion from the buyer side.

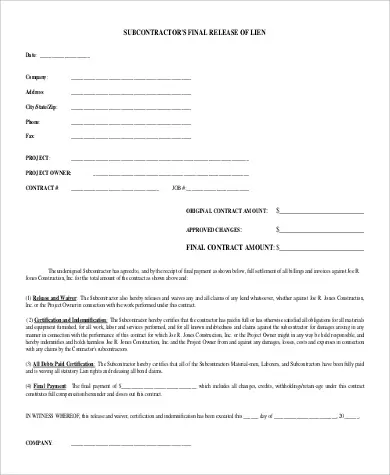

9. Release of lien for subcontractors

During a construction project, it is habitual to involve subcontractors for various jobs. The moment the desired deliverable is achieved, the contractor issues the waiver and lien release and also pays the amount mutually agreed.

This process is a win-win situation where the contractor acknowledges the movement and performance of the subcontractor. These release forms reduce the chance of scope creep in the project.

How to fill out a lien form?

- Gain access to the required conditional waiver and form.

- Enter all the information you know. Never sign until the entire space is filled out.

- As soon as your section is filled out, hand it over to the person (the other party) to get it completed.

- Ensure that you have fulfilled all the terms of the loan.

- Look for discrepancies in it and request for a change from the lender.

It takes less than an hour to request the form, complete filling the same, and then providing it back to the institution for approval. However, you should keep information handy at all times. Otherwise, it can take long hours and rejection from the client’s end.

FAQs

1. Does it need to be notarized?

You may have to check your state law relating to the lien form. Some states demand notarized documents while states like California invalidate a notarized document.

2. What is the average waiting period for lien release?

It takes anywhere between 30 and 60 days based on the lender. Some financial institutions process it extremely quicker if the queue is shorter.

3. Is it possible to get the title back?

Absolutely! You may have to write down your information and the new address so that the paper title is altered. However, a transfer fee is charged and you are asked to provide the registration card proving your ownership.

4. Is there a specific time when I should sign the lien?

Never sign till the moment it gets sanctioned. For instance, you may sign it but the management might not approve it. Never take this risk!

5. Can liens be avoided?

Yes, if there are alternatives followed. For instance, the parties might enter into an agreement to issue joint checks. In such instances, the purpose of a lien is ruled out.

Conclusion

The ideal way to use the waiver and lien release is to go through your state law relating to vehicles and properties. This will provide a broader insight into how it needs to be filed. As soon as you enter into an agreement involving a lien, you are expected to keep the waiver and release forms handy.

One of the templates listed in this article can guide you! Further, ask your financial institution for further information.