Digitization is everywhere and in everything. As the finance industry is getting digitized, managing accounts has become chaotic. Especially if you are paying back your debts, you tend to lose control of your account performances.

Eventually, you tend to pay beyond what you actually owe. Your rights as a debtor are also compromised. If you are paying backs your debts or know someone who does, remember that there are state laws to protect your interests and rights.

Feel free to ask the debt collector for information on the transaction! A debt payer has the same right as a debt collector.

Does that sound interesting? Do you want to know more? Let us understand the powerful document called the debt validation that makes finance management easier for debt payers.

Debt validation letter templates

The prime concern of every payer is to draft an effective and professional letter. If you think writing one is tough for you, we have a solution for it. This section has a range of sample debt validation letter templates that look printable and professional.

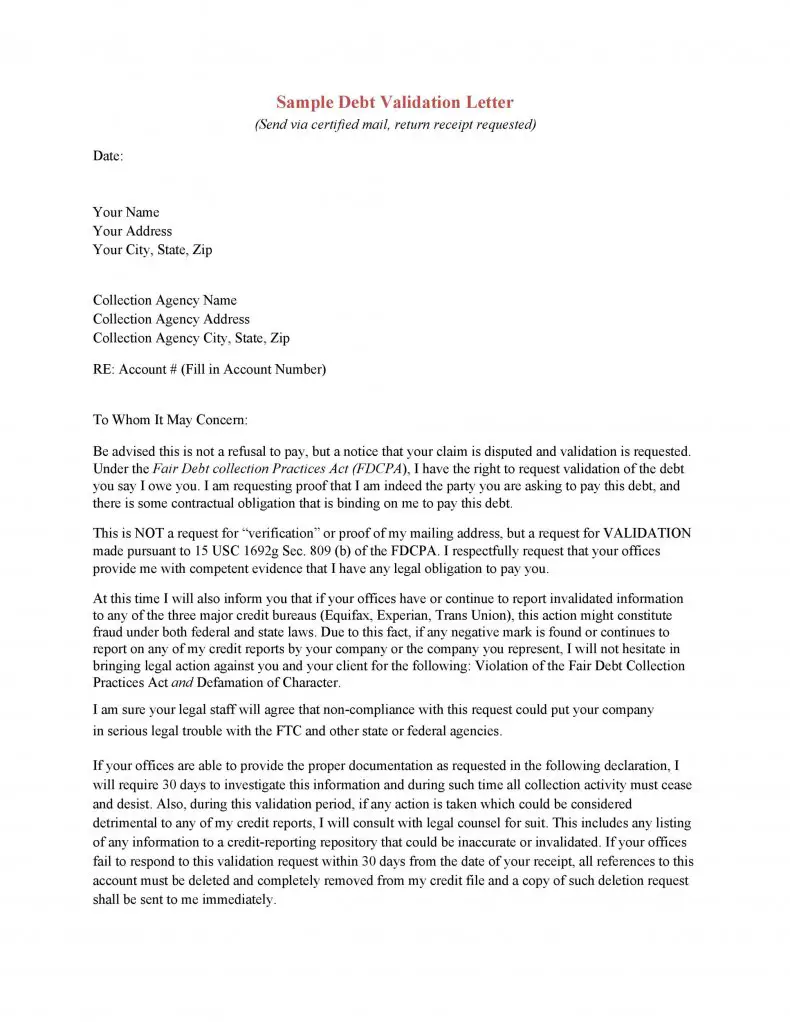

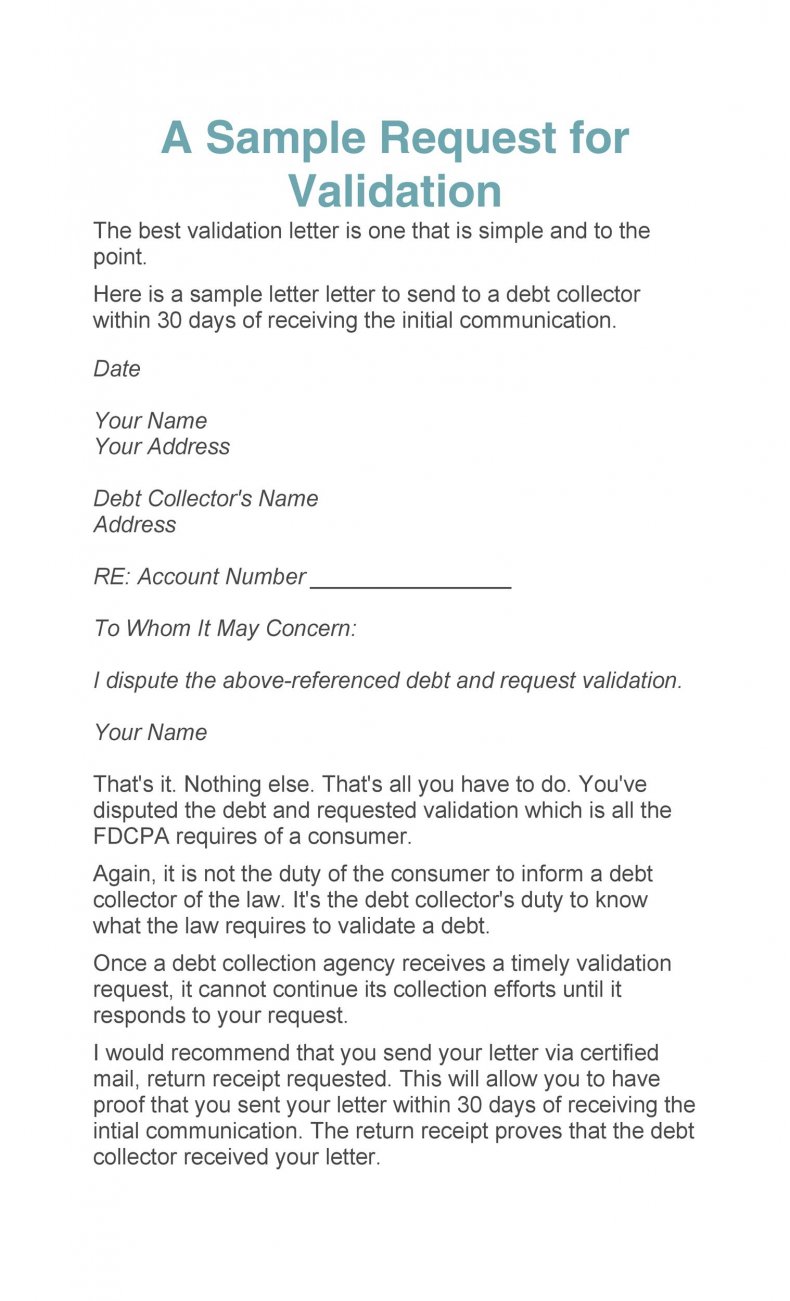

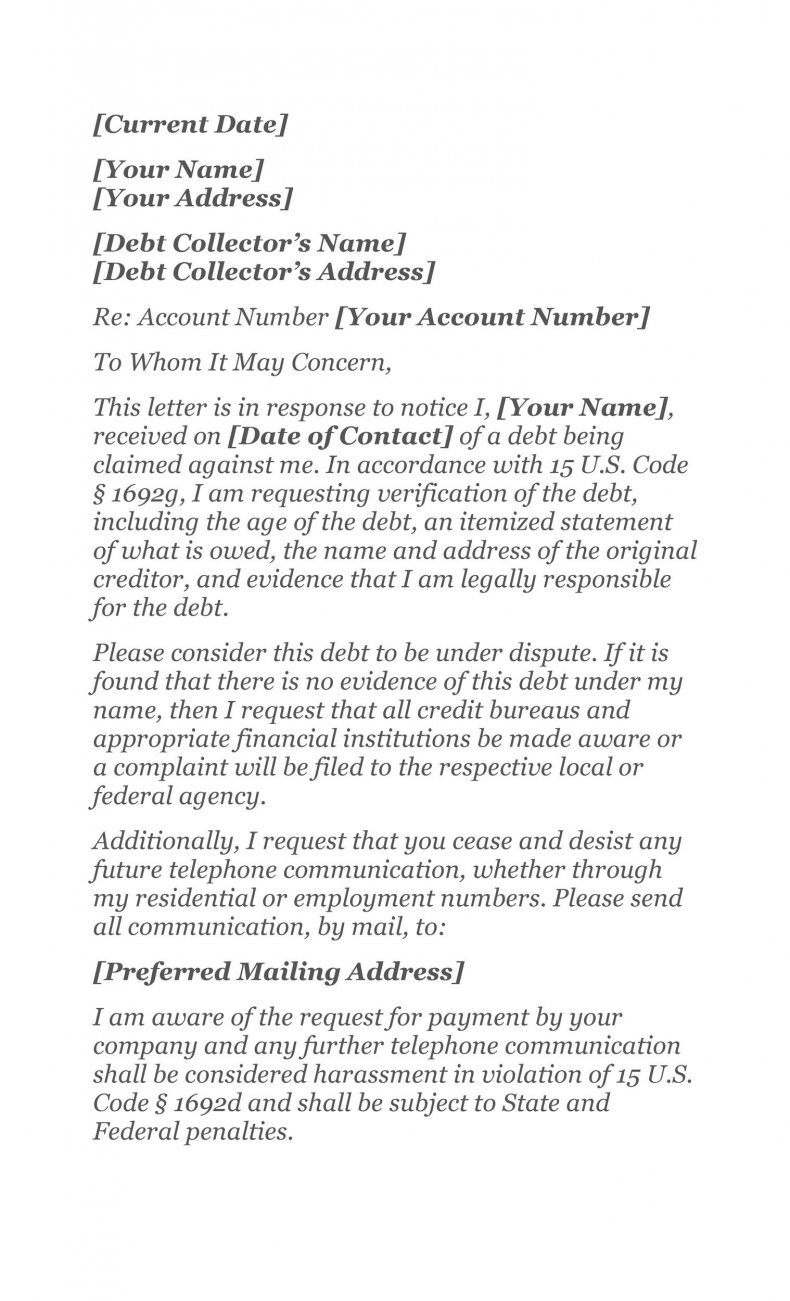

1. Sample Debt validation letter

Here is a quick template to fill down your details and send the validation request to the debt collectors. The best part about the template is that it references to the law which makes the purpose of the letter strong. As a payer, this makes you feel powerful. Edit your detail and hit that send button. Wait for 30 days for a detailed response.

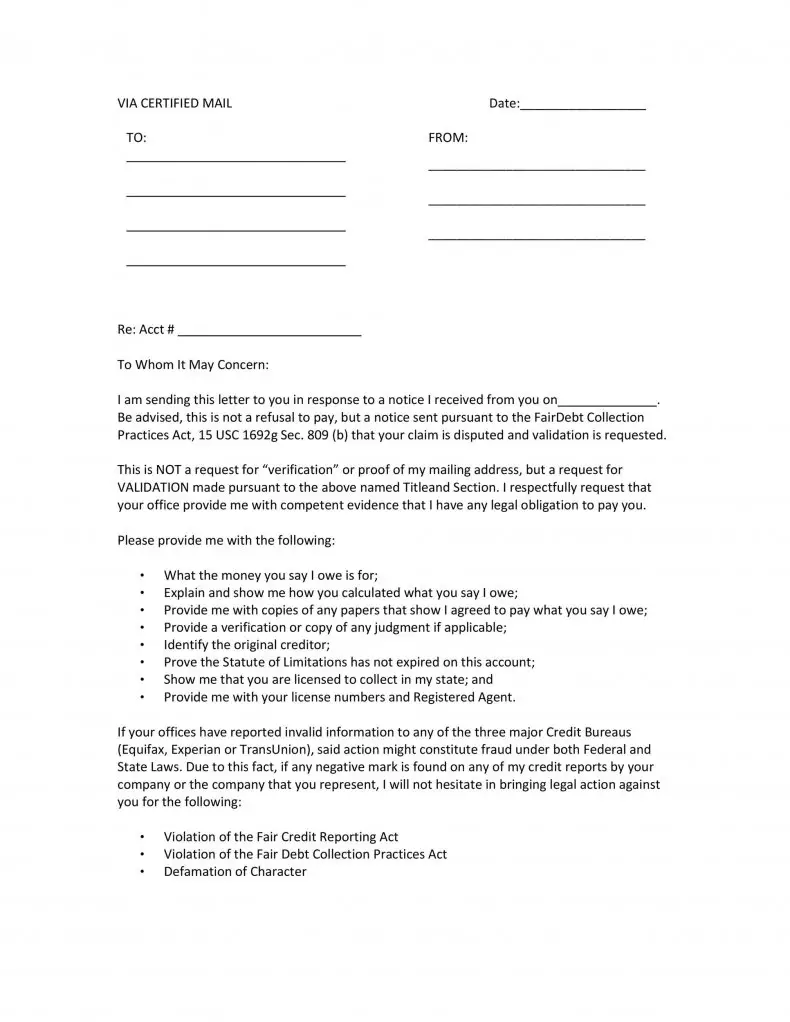

2. Legal debt validation

When you observe that your debt collector has been fooling you around, you need to establish a powerful note that questions various aspects of the transaction. This template allows you to question agency information, calculation procedure, the statute of limitations, and judgment copy if any. Most importantly, the template shows that you are an educated payer as it lists possible violations for which the collector could be penalized.

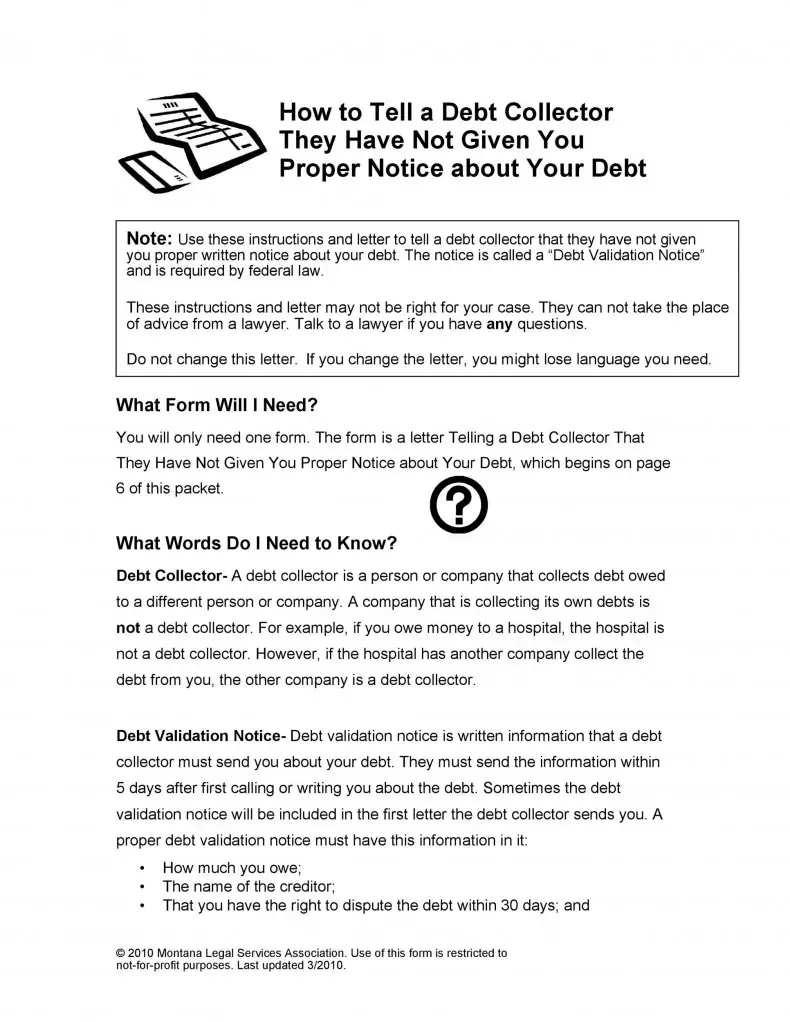

3. Debt validation for improper notices

If the debt collector has not provided you sufficient information about the debt collection agency, you need to make use of the notice that is approved by federal law. The template tells you how to use it and your rights when you have not received the notice from the debt collector. Subsequently, it also includes a ready-to-use template to write to your debt collector. This saves your time and educates you adequately about the process similar to a Roofing Estimate Template.

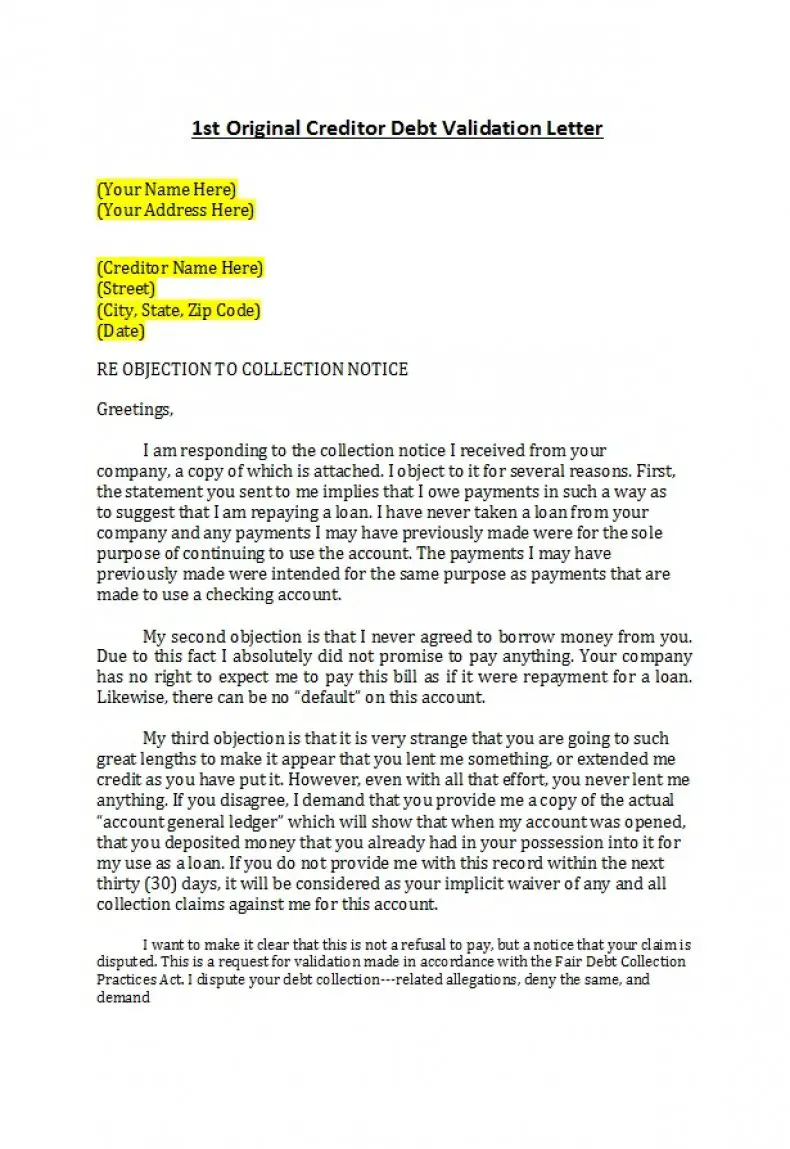

4. 1st original creditor debt validation

When the debt collector requests money from the debt payer but does not provide valid justification for the same, the payer has the liability to draft a detailed document with a list of objections. This letter is a perfect sample to present objections for the debt collection agency notice. As soon as you receive the debt collection request, you should use this letter format and enter your financial debt background to justify effectively.

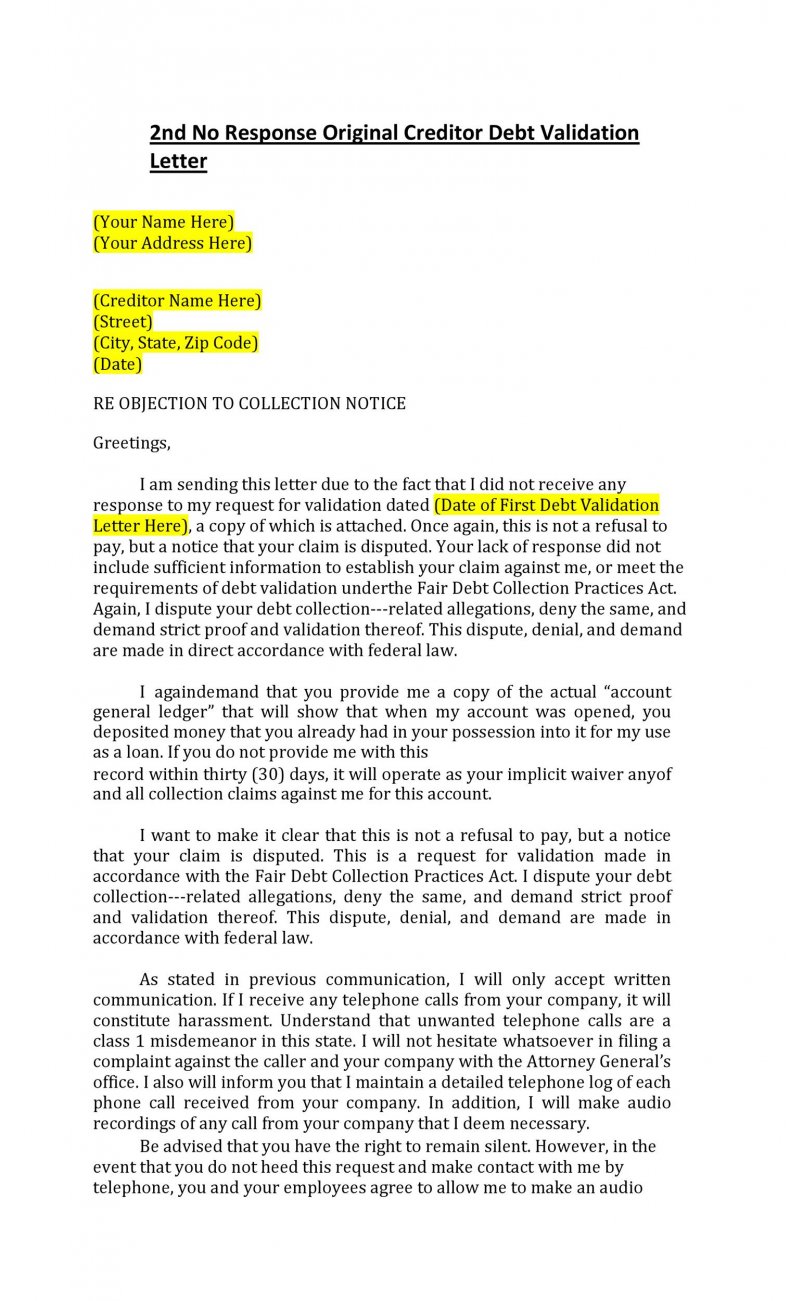

5. 2nd original creditor validation letter

This template is the continuation to the previous template. When the debt collector has not responded towards the previous notice, the next letter needs to be drafted by the debt payer. You need to highlight the points that the collector should answer and also connect to legal regulations to indicate potential violations and liabilities of the collector. Alternatively, if you are not satisfied about the first response letter received from the collector, you may also write for the second time but each time you delay or write, keep the due date and statutory charges in mind so you are not penalized any further.

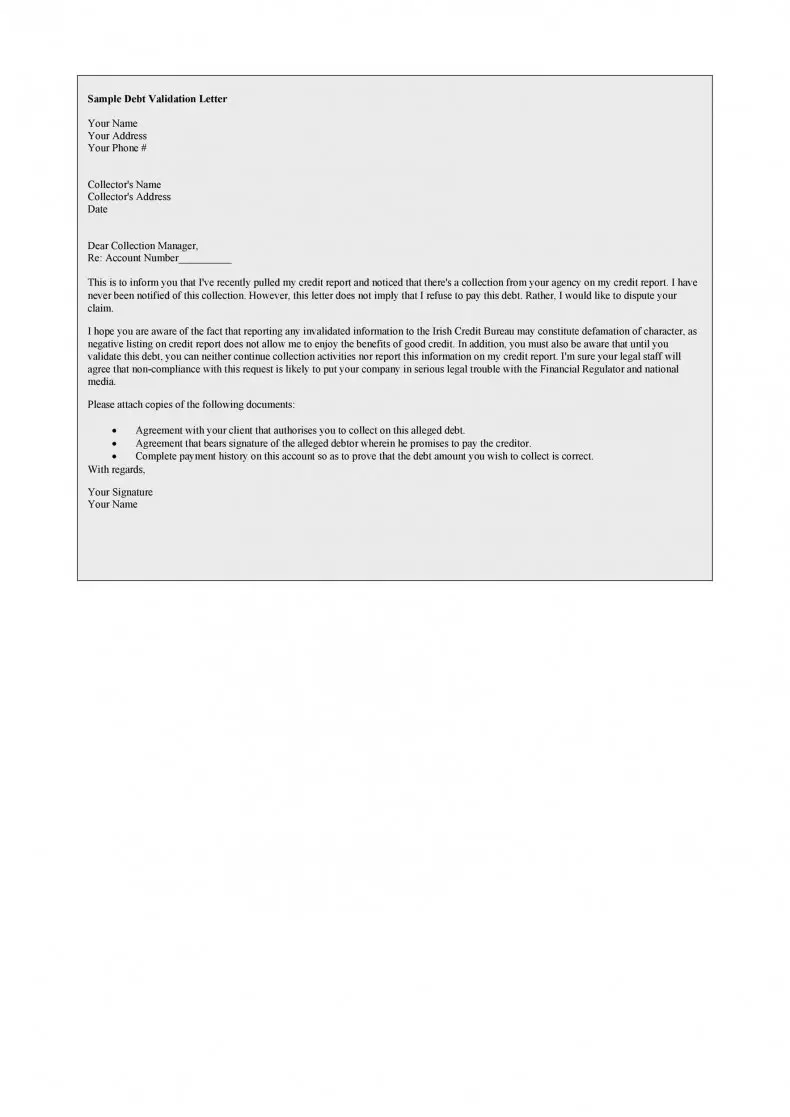

6. One page debt validation

When you prefer keeping your request crisp, this is the template to go ahead with. In general, the debt payer asks for three copies – authority, payment history, and signature of the debtor in the original document. The letter makes it clear on who owes whom and how much.

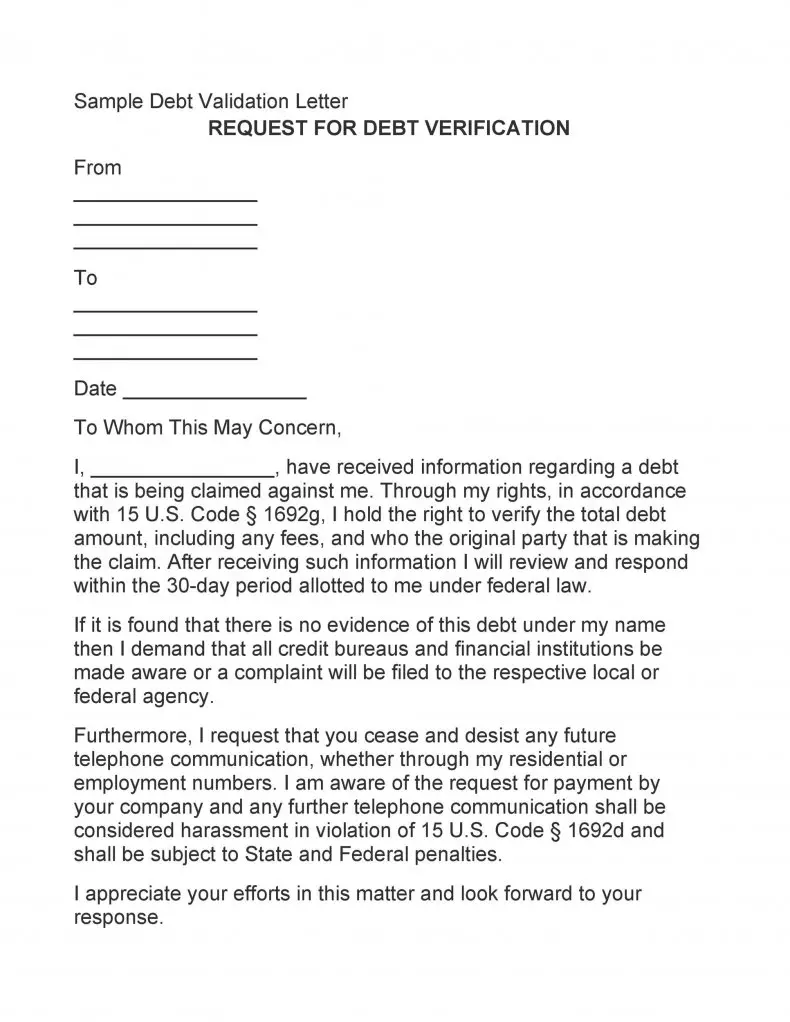

7. Request for debt verification

As a debt payer, you have the liability to request for details from the debt collector. If you are thinking about making the entire process short, you may write a few lines on what you think about the debt payment authenticity and ask for details. There are a few placeholders to enter your details and the details of the debt collector. Further, you should enter your debt information so that the agency may share further details.

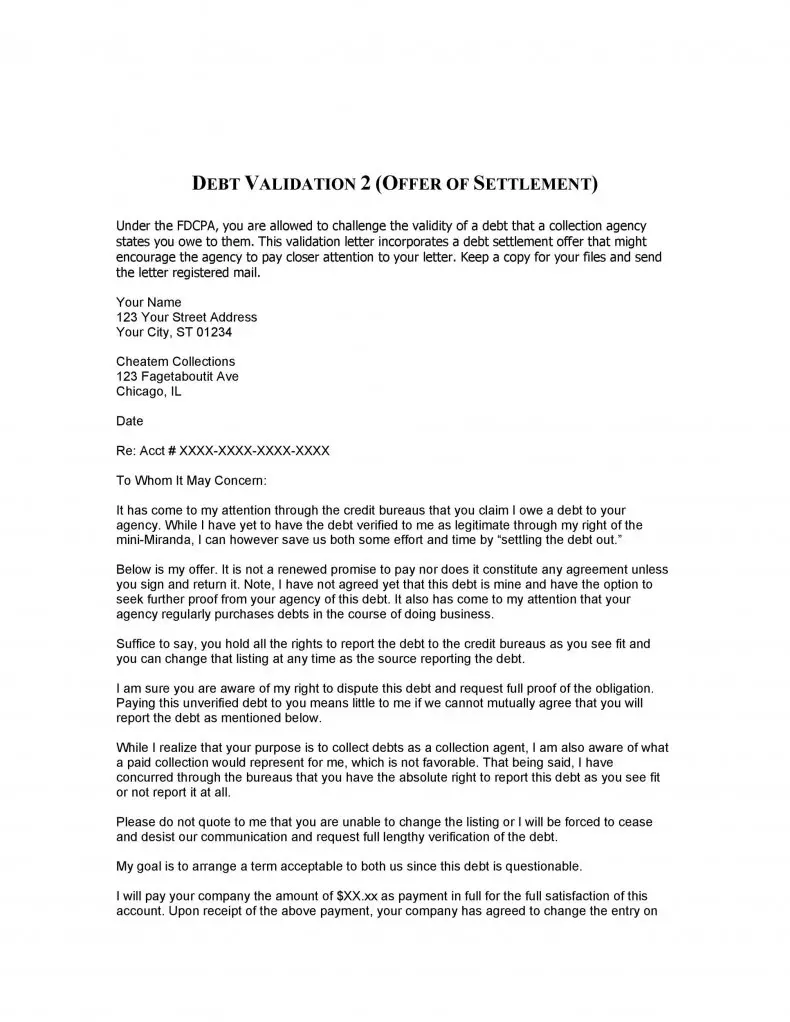

8. Offer of settlement

As a debt payer, you have the right to provide an offer of settlement. Suppose you have savings in your account and wanted to quickly settle some money and bring down the debt validity, you can write to the collector requesting for the consideration. The best part about the template is that it has the potential to gain the attention of the collector and make some decision towards the content in it.

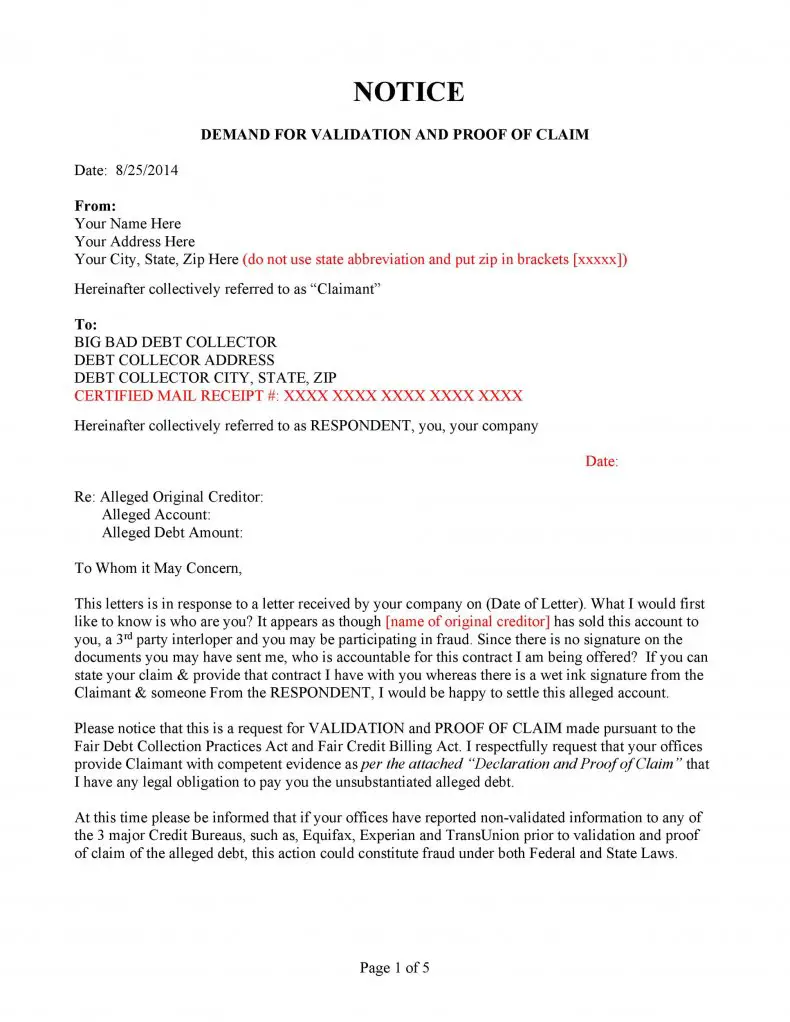

9. Demand for validation and proof of claim

Here is yet another sample allowing you to question your debt collector for the proof of claim. Each time you feel suspicious about the activity of your debt collector, you may use this multi-purpose template to validate authenticity and obtain the proof of claim. This is a detailed template referring to various State and Federal laws.

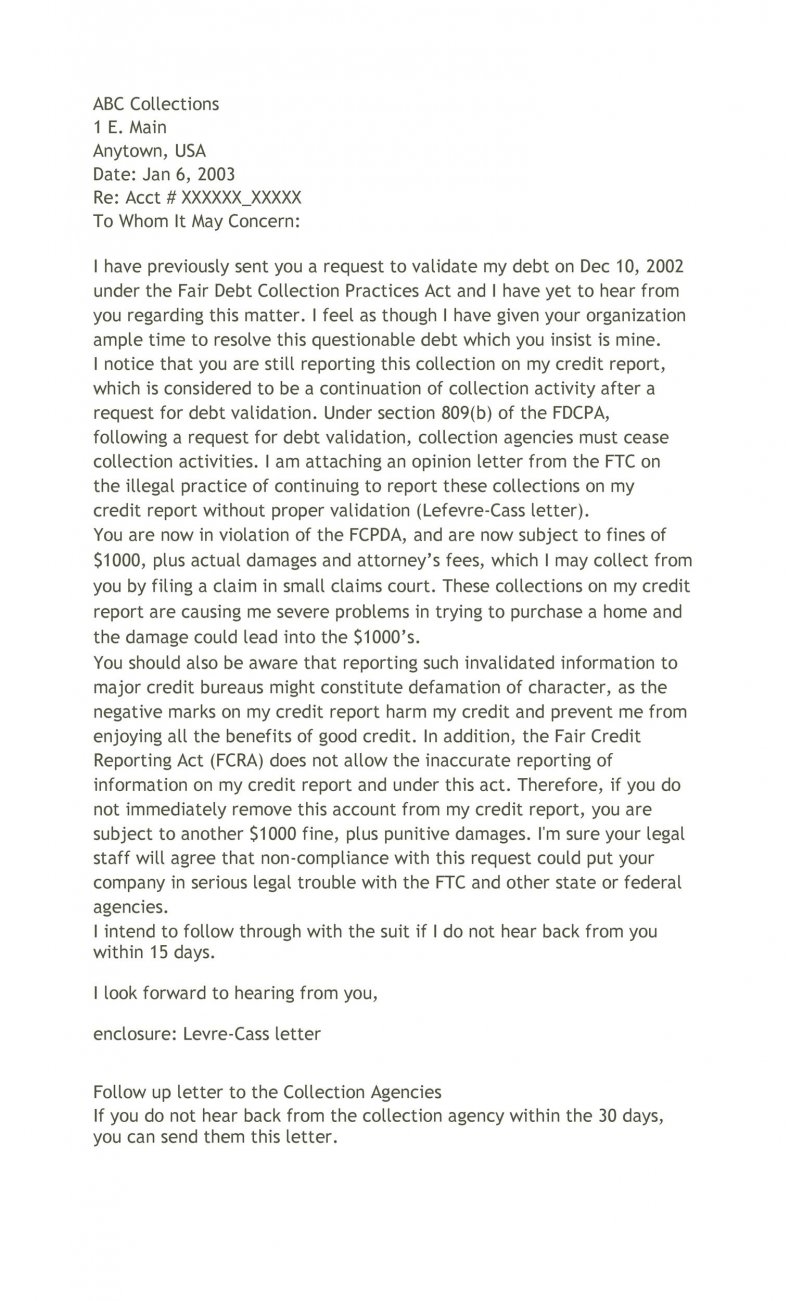

10. Debt validation follow-up letter

Having sent a sample and received some response to this, you may present a follow-up letter. Contrarily, if you have not received response, use this template to question about the credit report. According to State and Federal laws, the collector owes you a hefty fine for negligence and lack of response. If you are unsure of drafting an effective letter, this may do it on your behalf.

11. Debt dispute letter

If you have confirmed that the collector is not authentic, you should dispute again to get justice and also highlight times when the collector has collected knowingly/unknowingly.

12. Debt response letter

If you have received a response from the collector, it is time to respond properly. This template guides you to accomplish this task productively.

What is a Sample debt validation letter?

Each time a debt collector charges you with specific money towards debt payback, it is his/her responsibility to inform you about the purpose of the collection and further details about the transaction. As per the fair collection practices act (FDCPA), a debt notice in written format should be sent to the debt payer by the collector.

Due to the large number of debt payers associated with a financial institution, some collectors might delay or even skip sending the written notice. The ignorant payers continue to pay using these printable checks or allow the auto-debit option thereby losing money and rights on knowing the purpose of the transaction. When you do not receive a letter upon the first contact, you can write to the collector.

There are typically two situations when you can use a debt verification letter as a tool to probe the transaction.

- When you are keen to close the debt soon, you may use the letter to verify if the right collector is collecting money for the suitable debt.

- When the collector remains aggressive or hesitant about sharing information, you can use this tool to probe into further details and make a decision on payment.

There are a few key sections of a sample letter that you should make note of when you draft one.

- The amount owed by the payer.

- Creditor details such as organization name, address, and authority.

- A statement highlighting the validity of the collector if you do not dispute in 30 days from the date of the first contact.

- A statement highlighting the liability of the collector to provide further information within 30 days if questioned by the payer.

If you wish to collect specific information, you can ask for the authority of the agency, age of the debt, and also the reason for you to owe the debt. Sometimes, you may be obliged to pay the debt but you never know which one or who will collect it.

Note – Wait for 30 days after you draft the debt validation letter for the response from the collector.

Things to know about validation letter

Having known how a validation works, it is essential to know certain other facts of this process.

- Letters are generally initiated by collectors.

- The debt payer can always request for debt verification and the correspondence copy will have to be maintained.

- When you dispute the collector, it does not mean that debt will be eliminated from the credit report. It only means that you will receive further information about the transaction.

- Some agencies prefer calling the payer to share further information and complete the debt verification process. This can also seem like an add-on to the written statement provided by the collector.

- According to FDCPA, there are limitations to debt statutes based on the state. Certain debts cannot be collected after specific years. So, if your debt is obtained several decades ago, you should take a look at the debt statute of your state.

Note – A verification or a validation process does not imply the possibility to skip or ignore paying the debt you owe.

Conclusion

Drafting a validation letter needs to legally comply or you may be at stake. These templates are meant to guide you in seeking justice and doing the process rightly. Do not worry if you have a debt! Just ensure you know your right before borrowing money so you are always secured!

Check ut: